INCREASING THE BOTTOM LINE

While many factors impact a company’s bottom line (i.e. net income), four primary levers exist for companies looking to continuously grow net income. In this article, net income equates to pre-tax income as small businesses have no control over governments setting tax rates.

The

two levers used to increase sales are susceptible to the laws of supply

and demand, so understanding demand for the products is crucial.

1. Increase Sales By Increasing Prices

The

first lever available for a company to grow sales is to increase prices

of their products or services. Companies must identify the elasticity

of their product(s). Elastic products decrease in demand as prices

increases, whereas inelastic products are less sensitive to price

changes as consumers would continue to purchase the goods regardless of

price increases.

2. Increase Sales By Selling More Product(s)

The second lever to improve sales is the most difficult to increase net income because it takes the longest to accomplish. Companies seeking to improve sales for products accurately priced or products with large elasticity must resort to selling more products. Companies can increase prices at a relatively quicker pace than they can sell more products.

Entering new markets or diversifying product offerings can decrease the time to sell more products. However, entering new markets requires companies to understand and research the barriers to entry, consumer purchasing power, supplier power, and demand for the product. Entering a new market without due diligence can negatively affect a company’s ability to sell more products.

3. Buy Better

Negotiating

better purchasing terms from suppliers can increase net income.

Classified as Cost of Goods Sold (COGS), companies that negotiate

favorable purchasing terms allow for a higher gross profit (sales –

COGS). For example, if a consumer shops around for the best deal before

buying a new computer, he or she will have more money available after

the purchase to keep in their pocket. That same principle applies for

companies.

4. Control Operating Expenses

The last lever available for a company to increase net income is reining in operating expenses. Of the four levers, companies have the most control over maintaining operating expenses, particularly fixed expenses. If the laws of supply and demand do not allow a company to boost sales and the company is already purchasing under the most favorable terms offered by suppliers, then decreasing operating expenses temporarily relieves pressure on the bottom line.

While decreasing operating expenses from one year to the next increases net income, the amount a company can decrease operating expenses is limited. Reducing operating expenses too much can actually hinder a company’s ability to generate sales. For example, paying unfavorable salaries dampens a company’s ability to employ top talent. Another example includes decreasing the advertising budget so much that it prevents a company from reaching the widest audience.

How This All Combines

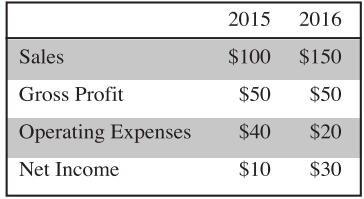

The company in the example above pulled one of the sales levers to increase sales. However, it did not pull the “Buy Better” lever as COGS grew by 100 percent compared to only a 50 percent increase in sales resulting in no change in gross profit. If COGS continue to grow faster than sales, gross profit will ultimately begin eroding.

The company also pulled the operating expenses lever by decreasing operating expenses by $20 (a 50 percent decrease) to help increase net income from $10 to $30, representing a 200 percent increase.

With these four levers, companies have 24 different combinations to increase net income. Knowing their market, their customers and the capabilities of the company will help guide a company on the best combination of levers to pull.

Ryan Thomas manages the loan review department for a local bank. His email address is rthomas@cbofla.com.

"Knowing their market, their customers, and the capabilities of the company will help guide a company on the best combination of levers to pull.”