The Shreveport-Bossier Outlook

A COVID and Post-COVID World

2020 has the makings of a horrendous year for the Shreveport-Bossier MSA. First, like elsewhere in the economy, many of its sectors were shut down or at significantly reduced operations due to the shelter-in-place orders mandated by the governor. Secondly, job losses were magnified in the MSA by the fact that this is a large gaming market with over 4,800 employees. The six casinos and the racetrack were totally closed from mid-March to mid-June. Things have become so dire that the smallest casino in the area – Diamond Jacks – has decided to close permanently, losing 349 area jobs. We are not optimistic that there is a long line of investors wanting to secure this license and keep it in this MSA.

Thirdly, suffering in the oil and gas extraction industry was felt in this energyintensive MSA. A fracturing firm – B.J. Services – filed a WARN notice with the Louisiana Workforce Commission of its intention to lay off 273 people. Cactus Wellhead terminated 42 people. Unfortunately, the primary customer for the steel produced at Benteler Steel at the Port is the oil and gas exploration industry. The plummeting U.S. rig count (a stunning drop from 1,038 on Feb. 28 to 247 Aug. 7) caused Benteler’s workforce to slump from 530 to 158. These losses were partially offset when Haliburton moved its Kilgore location to Bossier City. Haliburton had 223 workers at the Kilgore site, but it is not clear what the net boost in the Bossier City headcount would be.

Fourthly, two very meaningful employers announced plans to shutter their facilities in this region. Libby Glass announced plans to close its 450-person facility by the end of 2020, and Cleco Power announced plans to shut down the Dolet Hills mine (-155 jobs) and Mansfield power plant (-88 jobs).

The result of all this is we estimate this MSA lost 11.6% of its jobs in 2020-H1 – the third-worst performance in the state (after New Orleans and Lake Charles). In 2020-H2, we expected jobs to begin to return as a result of the governor taking the state toward reopening. We expect the gaming industry – though still at 50% capacity restrictions – to recover relatively quickly, though the loss of Diamond Jacks will hamper that recovery. Unfortunately, the permanent loss of three major employers – Libby Glass, Diamond Jacks Casino and Dolet Hills – will also act as a permanent drag on the recovery this year.

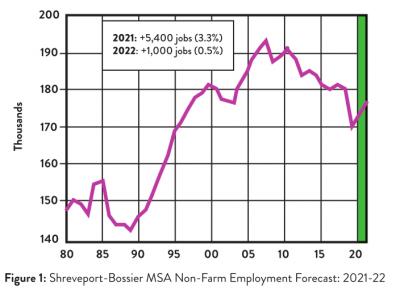

As seen in Figure 1, we estimate that the Shreveport-Bossier MSA will end 2020 down a net 10,600 jobs (-5.9%). This will make this MSA the third worst-hit MSA in the state and leave the region 22,700 jobs (-11.5%) below its peak employment back in 2008.

Forecast for 2021-22: How much can Cyber, the Port and Ochsner do to bring it back?

The Shreveport-Bossier MSA will have a lot to overcome over the next two years, having lost three significant employers. How strongly the region recovers will fall heavily on activity at the Port of Caddo- Bossier, the Cyber Research Park and Ochsner Health System. As seen in Figure 1, we are projecting that this MSA will add 6,400 jobs (+3.8%) in 2021 and another 1,000 jobs in 2022 (+0.6%). This will be the fourth best performance in the state over those two years. However, note in Figure 1 that by 2022, the MSA will still be well below its pre-COVID-19 employment level. We anticipate it will be at least 2023 before the region recovers all of the jobs lost in 2020.

Hope for Big Hit at the Port

With one exception, activity at the Port of Caddo-Bossier was a helpful source of stability for this MSA during the pandemic. Sports South finished an addition to its Knapp automation tower and kept its employment at 245 – a figure expected to change little over 2021-22. Basically, that was the same message from Morris Dickson, where 230 are employed, with little change expected over the next two years. Omni Specialty Packaging is a state-of-the-art oil blending and packaging facility located on 30 acres at the Port of Caddo-Bossier. Omni employs 254 people, but unlike the previously mentioned tenants, Omni expects employment to expand over 2021-22.

Ronpak

– a company that makes packaging products for companies like Popeyes,

What-A-Burger, Church’s and Five Guys – has grown from 50 employees in

2012 to 150 in 2020. Ronpak is adding machines and employees over the

next two years. Pratt Industries is the nation’s sixth largest

paper/packaging company. Pratt has 118 workers at its Port site, a

number that is not expected to change anytime soon. The company has

about $13 million in capital spending underway, with plans for another

$5 million over 2021-22. Ternium is an international steel company that

manufactures steel products at the Port from ore derived from the

company’s mines. While Ternium’s workforce is stable at 165, the company

did defer a $2.3 million project scheduled for 2020 into 2021 and has

deferred two other major projects ($8.3 million and $7.8 million) for

now as a result of COVID-19. Calumet Packaging manufactures and packages

various oil and chemical products via its 75-employee facility at the

Port. While employment is not expected to change much over our forecast

period, the firm is considering a significant $15 million capital

investment. A smaller unit at the Port, ADS Logistics, has 15 warehouse

workers and seven truck drivers. The firm hopes to add five to seven

truck drivers over 2021-22.

Ronpak

– a company that makes packaging products for companies like Popeyes,

What-A-Burger, Church’s and Five Guys – has grown from 50 employees in

2012 to 150 in 2020. Ronpak is adding machines and employees over the

next two years. Pratt Industries is the nation’s sixth largest

paper/packaging company. Pratt has 118 workers at its Port site, a

number that is not expected to change anytime soon. The company has

about $13 million in capital spending underway, with plans for another

$5 million over 2021-22. Ternium is an international steel company that

manufactures steel products at the Port from ore derived from the

company’s mines. While Ternium’s workforce is stable at 165, the company

did defer a $2.3 million project scheduled for 2020 into 2021 and has

deferred two other major projects ($8.3 million and $7.8 million) for

now as a result of COVID-19. Calumet Packaging manufactures and packages

various oil and chemical products via its 75-employee facility at the

Port. While employment is not expected to change much over our forecast

period, the firm is considering a significant $15 million capital

investment. A smaller unit at the Port, ADS Logistics, has 15 warehouse

workers and seven truck drivers. The firm hopes to add five to seven

truck drivers over 2021-22.

All that solid stability in these rough times was good news for the Port. Unfortunately, the news was not good for the Port’s largest employer, Benteler Steel. Benteler’s output primarily goes into pipe used by the very depressed oil and gas extraction industry. In response to this reduced demand, Benteler recently reduced its workforce from 530 to 158. As its clients’ sector rebounds over the next two years, the firm projects moving back up to 280 employees. Benteler also plans to invest $1 million in a furnace floor upgrade.

Presently,

there are about 1,800 people employed across all tenants at the Port.

In 2021 the Port will finish work on a new $14 million,

100,000-square-foot warehouse for steel products and distribution.

Looking to the next two years, we are hopeful the Port will be able to

finalize talks with a new client for the Port that would use existing

infrastructure and a considerable number of new barges for a new $325

million facility at the Port. The company is at the stage of seeking

angel investors. The Shreveport-Bossier MSA really needs the Port to

land this prospect.

Another Big Client for Cyber Research Park?

A relatively new economic gem for the Shreveport-Bossier MSA is the National Cyber Research Park (NCRP). The campus proper consists of three buildings: (1) the Cyber Innovations Center, (2) the General Dynamics I.T. Center, and (3) the Louisiana Tech Academic Success Center. In addition, there is a 300-person call center located on Benton Road. Over 2009-2017, over $165 million was spent constructing the three buildings on campus. There are about 1,200 people presently employed at these four facilities – the majority at the General Dynamics I.T. Center.

We are expecting the NCRP to be a significant factor in this MSA’s potential growth over 2021-22. General Dynamics (G.D.) has been a steady contributor of new jobs at the park, and we do not expect that to change. G.D. should add 100-200 jobs over our forecast period. The Cyber Innovations Center has recently added 20 new jobs and will be adding another 20 soon.

Work will begin late summer this year on a new $22 million Louisiana Tech Research Institute that will eventually employ 400 people and house professors and staff working on classified research in the cyber field. The build-out will take about 19 months. We are anticipating that before the LEO goes to press, CEO Craig Spohn will announce a new 100-person firm at the park.

Critical

to this MSA’s immediate future, there are high hopes that the Park will

land another 600-1,000-person firm as a result of the Air Force’s WERX

program. AFWERX is intended to engage inter- and extra-service

innovators and entrepreneurs in the operations of the USAF. There will

be a new building for the campus associated with this new firm, but the

exact size has not been established. Landing a firm of this size would

go a long way toward reversing the MSA’s recent decline pattern.

Positive News at Barksdale

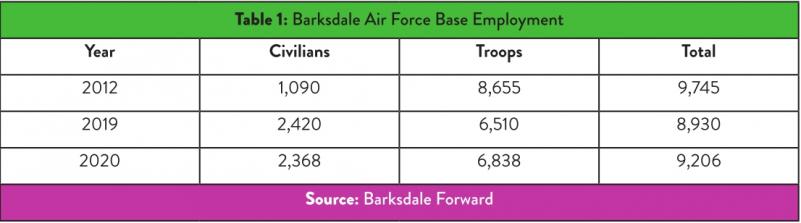

Speaking of the Air Force, the largest employer in this MSA is Barksdale AF Base. Part of the reason for the decline in total employment in this region has been the fall in troop/civilian employment at Barksdale, as shown in Table 1 (page 6).

Note that between 2012 and 2019, total employment at the base dropped from 9,745 to 8,930, a non-trivial loss of over 800 jobs, all due to a reduction in troop strength at the base. That trend was nicely reversed in 2020 with total employment rising by 276 to 9,206.

In addition to employment additions, there are two significant capital projects underway at the base and a very large potential one for 2022. Ground was broken this year on the $70-$90 million I-220 exchange, and work should start this fall on the $46 million entrance to the base.

A

hopeful eye is focused on 2022 when the trigger might be pulled on a

$170- $225 million weapons storage facility at Barksdale. This would be

one of the largest capital expenditures proposed in the region and a

great boost for the MSA.

Saving Fibrebond + BRF, Williams, Tomakk, Airport and Roads

The Shreveport-Bossier MSA dodged a major bullet since our last edition of the LEO. Fibrebond is a 752-person plant in Minden that manufactures very heavy modular electrical enclosures from galvanized sheet steel. Primary customers for Fibrebond’s products are located in south Texas, requiring the firm to move its product across a bridge over the Sabine River into Texas. That bridge was not rated highly enough to handle products of this size, so the company was considering moving all of its operations across the river into Texas.

In October 2019, an agreement was reached with the state to bring 50 miles of heavyhaul route from Minden to Texas – saving the firm from leaving Louisiana. We were told that if this agreement were worked out, Fibrebond would (1) invest an additional $2.5 million in the plant and (2) add 50-75 new jobs.

During the last 34 years, the BRF (formerly the Biomedical Research Foundation) has been a significant spur for growth in this region and has added stability in the recent crisis. There are three key units under BRF’s umbrella: (1) firms occupying BRF facilities in the InterTech Science Park (ITSP), (2) activities of BRF and its business units, (3) firms in the Entrepreneurial Accelerator Program (EAP). Total employment in these units is just north of 600, a figure expected to remain relatively stable over 2021-22.

Webster Parish announced a new win in February. E.I. Williams, a manufacturer of industrial sound control equipment, will be investing $700,000 in an existing building and creating 100 new jobs paying an average of $37,400 annually. Tomakk Glass Partners also opened a new $1.9 million plant to make tempered glass, frameless shower enclosures and insulated windows. Thirty jobs have already been filed at the plant, and another 20 are expected over our forecast cycle.

A close eye should be directed at two MRO (maintenance, repair, overhaul) companies at the Shreveport Airport. Western Global Airlines moved into the old Express Jet facility and ramped employment up to 125. However, the impact of COVID-19 on airline traffic caused the firm’s employment to back off to 60. Once the recovery is underway, we expect employment at this site to reach 170 by the end of our forecast period.

In January, just before the pandemic started full bore, Advanced Aero Systems announced plans for a new MRO facility in Hangar 5 at the airport. The initial plan was to start with 60 new jobs (at $49,600 annually) in this hangar, then build a new hangar nearby and expand to 500 jobs by 2024. The pandemic has clearly stymied those plans. Presently, the firm has only two employees and two contract workers, but the potential is there for nice growth once the recovery is underway.

This MSA will also get a little bit of a boost from extra spending on roads and bridges over 2021-22. The total tab for state road lettings for this MSA is $127 million, up from $110.8 million last year. The three biggest projects are:

• $42.1 million for rehabilitation of I-20 west of LA3 to Airline Drive;

• $21 million on the Caddo Lake Bridge; and

• $16.5 million on the bridge on US80 near Minden.

Cautious Optimism about Haynesville?

Is there any reason to be hopeful about a revival in the Haynesville Play in this region? The rig count in this play peaked at just over 140 during the heady days of 2008-09. It presently sits at about 26 rigs. Last year, we would have argued that the country was awash in natural gas, and prices would stagnate at near $2 per MMBtu – not good for a dry play like the Haynesville.

However, a stunning decline in the U.S. rig count from 1,038 in February to 242 means much less associated natural gas produced in the shale basins and a consequent rise in natural gas prices to at least $3.10 in 2022. Above $3 per MMBtu, natural gas prices could deliver a serious positive jolt to the Haynesville Play and get the rig count rising again.

In addition, we are pretty optimistic that ground will be broken on at least one and maybe two new LNG projects in southwest Louisiana over 2021- 22. The new Venture Global project is already underway as are plans to add a sixth train at the Cheniere site and two more trains at the Sempra site. All these facilities will need natural gas feedstock, and the Haynesville is much closer than the Permian Basin in West Texas. Indeed, we are aware of at least one pipeline – the Lumberjack – proposed to bring natural gas from the Haynesville down to south Texas to feed those LNG facilities. All this makes us cautiously optimistic about a recovery in the Haynesville over 2021-22.