The Shreveport- Bossier MSA

Dr. Loren C. Scott & Associates

Amazon Delivers – Jobs!

Louisiana’s fourth largest MSA is located in the northwest corner of the state. Four parishes – Caddo, Bossier, Webster and DeSoto – make up the Shreveport-Bossier MSA. There are an estimated 169,900 nonfarm jobs in these four parishes in 2021.

Unlike the other eight MSAs, a key metric for this MSA is its relatively high dependency on durable goods manufacturing employment, which makes the area much more susceptible to national recessions. Some of the larger durable goods manufacturers are:

• Sabre Industries – (formerly, CellXion) a manufacturer of cellular towers

• Frymaster – a manufacturer of deep fryers and similar products for McDonald’s and KFC

• Ternium – a steel components manufacturer

• Benteler Steel – a large steel plant at the Port of Caddo Bossier

• Fibrebond – in Minden, which manufactures modular electric buildings for data. Three major players in this market are:

• The Caddo-Bossier Port, which is home to several firms including Ronpak, Sports South, the Ternium steel firm, the Pratt recycling company and Benteler Steel. Altogether, tenants at the Port employ about 1,763 people.

• BRF employs 614 people at its various facilities, including its incubator support for new firms. It is home to the new Center for Molecular Imaging & Therapy.

• The Cyber Research Center, which is a major new and growing player in the region with 1,350 employees at its three centers. Shreveport-Bossier is also home of the Haynesville Shale – a very large deposit of natural gas, one of the first plays to use the fracking technology. Exploration companies invested $4.5 billion in new dollars (including about $3.2 billion in mineral lease payments) into the northwest section of the state in 2008. The following year, that figure rose to $7 billion (including about $1 billion in mineral lease payments). The Haynesville is poised to be a significant factor in this region’s economy over the next two years.

The military plays an important role in this MSA, because Bossier City is home to Barksdale Air Force Base, an employer of 9,206 military/civilian workers.

Shreveport-Bossier is also the state’s second largest casino market. This MSA now has five large riverboat casinos plus the Harrah’s Racetrack, which together employed 4,146 people in 2019.

Like every other MSA in the state, the Shreveport-Bossier area was clobbered by COVID. This MSA lost 13,300 jobs on average in 2020, a decline of 7.3%. In April 2020, this first full month of the shutdown employment in the area fell a full 23,400 jobs or 13%. The region had 4,542 people employed in its six casinos and another 188 at the Harrah’s Racetrack before COVID hit. All those gaming venues were closed from mid-March to mid-May and then were only allowed to reopen initially at 25% capacity. The region’s smallest casino – DiamondJacks – closed permanently, and attempts are underway to move that license to St. Tammany Parish.

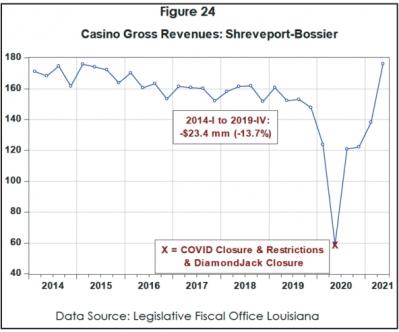

As seen in Figure 24, gross revenues at these casinos took a severe beating in the first two quarters of 2020, dropping from $147.8 million in 2019-Q4 to $59 million in 2020- Q2 – a stunning decline of 60%! Remarkably, by 2021-Q2 gross revenues had not only fully recovered but also had reached a new record for the MSA of $176 million. And that happened with one less casino in the region. We attribute this remarkable recovery to the large stimulus checks that citizens received during this period. Though gross revenues have more than come back, the same cannot be said for employment. In the pre-COVID quarter of 2019-Q4, there were 4,542 people employed in the region’s six casinos. A year later in 2020-Q4 (latest employment data available), there were 2,515 workers at the five casinos operating. Over 2,000 jobs vanished in one year. It is tough for an MSA of this size to overcome a loss of that magnitude.

Readers can also see in the graph in Figure 24 the influence that the new Indian casinos in Oklahoma have had on this region’s casino market. In the pre- COVID years covering 2014- Q1 through 2019-Q4, gross revenues at the six casinos in the area declined 13.7% or $23.4 million.

In addition to jobs lost in the gaming sector, other major closures hit the Shreveport-Bossier MSA. Libby Glass shuttered its 450-person plant in Shreveport, and Cleco Power shut down its Dolet Hills lignite mine and power plant (-243 jobs).

Employment at Benteler Steel at the Port of Caddo Bossier fell from 395 to 240, and Western Global’s MRO unit at the Shreveport Airport shed 65 jobs.

The good news is that by June 2021, this MSA had recovered 57% of the jobs lost in April 2020 due to COVID, a significantly better record than the state as a whole (+49%). A real boost over 2020-21 came from the capital spending and other expansions at the Ochsner-LSU Health Sciences Center Partnership. We have estimated new operational and capital spending by the Partnership created 1,575 new jobs in Caddo Parish over those two years. Employment at the Cyber Research Park also continued its steady growth, which added another shot in the arm to the recovery.

Forecast for 2022-23: Amazon plus Haynesville?

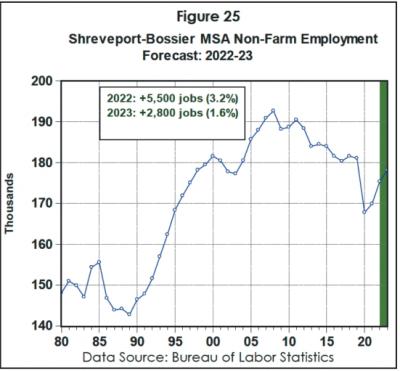

As shown in Figure 25, we are forecasting something unusual for this MSA given its recent past – three straight years of job growth. After COVID recovery in 2021, we are projecting that this MSA will pick up 5,500 new jobs (+3.2%) in 2022 and another 2,800 jobs (+1.6%) in 2023.

Major Bump from Amazon

Economic developers and government officials did a victory dance when Amazon announced it would place one of its fulfillment centers in the Shreveport area. This $200 million robotic center will be located in the Hunter Industrial Park and should open in the fall of 2022. An impressive 1,000 new jobs are projected at the plant, a one-time job boost the likes of which this MSA has not seen since the Haynesville Shale boom in 2008-10.

Readers should keep in mind that this is unlikely to be a net 1,000-job addition to the region. One reason Amazon is doing so well is buyers are switching from going to retail stores to ordering online. That means fewer retail jobs. However, Shreveport was very lucky; this facility could have been located in Tyler, Ruston, Natchitoches or anywhere else. It located in Shreveport and is bringing 1,000 new jobs.

A Major Bump from the Haynesville?

Note the question mark after this heading. Will 2022 be the beginning of a serious resurgence in the Haynesville Shale? The Norwegian energy research firm Rystad is projecting gas production in this play will ramp up by 86% between now and 2035. Several Bossier Parish. There are now 1,200 people factors are driving this optimistic forecast.

First, back in the “Basic Assumptions” section we estimated that natural gas prices would enjoy a price jump that would leave it in excess of $3 per MMBtu. We also cited a Chesapeake estimate that the break-even price in the Haynesville Shales is now in the $2 -$2.25 range. At these higher prices, the Haynesville is suddenly a profitable play. Indeed, when natural gas prices exceeded $4 per MMBtu in July, S&P Global Platts Analytics estimated the rate of return on investment at 29% in the Haynesville.

Second, the Haynesville has a location advantage over the Marcellus Play in the Appalachian region because of the ease of transporting gas from the wellhead to the Gulf coast markets. The addition of the LEAP, CJ Express and Index 99 pipelines have enhanced this advantage. If the play is to achieve the 86% growth Rystad has projected, the Gulf Run Pipeline will need final FERC approval or the region’s pipelines will be over-utilized by 2024-Q4.

Third, there is evidence from M&A activity that producers are increasingly interested in the Haynesville. Southwest Energy spent $2.7 billion to purchase Indigo Natural Resources and Chesapeake spent almost the same amount ($2.2 billion) to purchase Vine Energy. A fourth advantage for the Haynesville is the nature of its investors. The Marcellus Play is dominated by investor-owned exploration companies. These companies are beholden to investor pressures that have kept these companies from increasing production. By contrast, Haynesville operators are dominated by private equity-backed firms, with a stronger focus on production and making money.

Finally, Tellurian is making a big move into the Haynesville because the firm plans to control all the natural gas needed to supply its proposed Driftwood LNG in the Lake Charles area. Indeed, Tellurian has basically said the sanctioning of the Driftwood facility depends on it controlling 1.5 bcf/d of natural gas. At this writing, the firm controls 100 mmcf/d, and it wants to start construction of its LNG facility in 2022.

All of these factors are painting a much rosier picture for this play over the next two years. In fact, the rig count in North Louisiana has jumped from 20 to 34 in July compared to last year.

Another Growth Target: Cyber Research Park

A serious growth engine for this MSA recently has been the Cyber Research Park in working at the three main units at the Park. General Dynamics is the largest player with about 1,100 high-wage jobs.

There are 80 on the staff of the Cyber Innovations Center and another 300 at the call center on Benton Road. Construction is underway on the $22 million Louisiana Tech Research Institute, which will start with about 200 employees when it initially opens in 2022, and then will grow to 500.

The Cyber folks are working on two other large projects, which, if landed, will result in another significant kick upward in employment in the area. One is a potentially 600-1,000-job firm associated with the Air Force’s Strike WERX program, which would engage inter- and extra-service innovators and entrepreneurs in the operations of the U.S. Air Force. A second possibility – Project X – is more secretive and could generate up to 2,000 new jobs. As an important aside, the Cyber Research Park also attracts 4,000+ visitors a year who spend money in local restaurants, hotels, etc. – another nice boost to the economy.

Port of Caddo-Bossier: Still a Star in Region’s Economy

One of the real bright lights in this MSA’s economy over the past several years has been the Port of Caddo-Bossier. Looking forward, these units will still be adding jobs and capital expenditures to the region.

There are 1,763 people employed at the various firms at the Port. As a reference point, that is only 500 jobs lower than the total civilian workforce at the huge Barksdale Air Force Base (2,263). Family company Sports South is a weapons distributor at the Port and is the Port’s largest employer at 335. Pharmaceutical company Morris Dickson is the second largest employer at the Port with 206 employees. The firm expects to add 10 new jobs over 2022-23.

The third largest, relatively new plant at the Port is Benteler Steel. Prior to COVID there were 395 people working at the site, but that number ultimately fell to 240. Employment is projected to increase to 380 by 2023-Q3, a nice 140-job increase. Benteler will also spend $10 million over the next two years on a heat rerating project, new furnace floor designs and an improved throughput project.

International steel company Ternium presently employs 163 people and will grow that number to 198 over the next two years. Ternium will be spending $15.2 million on multiple projects to improve production, infrastructure and safety. Pratt, a paper and packaging company, has a $10 million project presently underway and will add five new jobs to its 114-person workforce over the next two years.

Another $10 million project is planned for 2022-23 for better traffic, raw material inventory holds, and equipment. Calumet Packaging has a 90,000-square-foot facility located on a 15-acre tract at the Port. The facility manufactures and packages engine oils, hydraulic fluid, gear oils, transmission fluid and functional chemicals.

What is really encouraging is that the Port is near the final attraction of two new firms to the Port. One is a regional frack sand company (see our discussions of the Haynesville Shale prospects above) that would spend $25-$36 million on its processing facility and create 60-90 new jobs with starting salaries of $55,000- $85,000 a year.

The second prospect is a new $325 million plant that would use existing infrastructure and units and would add a large number of barges to the traffic at the Port. A decision on this prospect is anticipated for 2022-Q1.

Either prospect would be a nice economic development win for the region.

Ochsner, BRF, Fibrebond Continue Growth

Additional jobs are projected from a number of other sources over the next two years. The Ochsner- LSU Health Sciences Center was a major job contributor over the past two years and should continue so over 2022-23. The Partnership is projected to add 240 new jobs over 2022-23 and spend some $25 million a year on capital projects. The latter will include a new community health center, continuing renovations at the Kings Highway campus, an additional 25 inpatient beds at St. Mary and a new building for intensive outpatient treatment of mental disorders. There are 614 people employed directly at BRF entities. BRF recently attracted Omicron Technology Solutions – a software-as-a-service developer, hiring 20 new people. Work will be completed early next year on the $20 million Center for Molecular Imaging and Therapy on the BRF campus. The highly successful Fibrebond Company, which manufactures modular electrical enclosures, has 450 employees. Fibrebond would like to hire about 50 more people but is having a very tough time finding qualified electricians.

Honeywell is making an additional $75 million investment at its plant on Mooringsport Road. That will generate 15 new jobs. The 170-person Continental Structural Plastics facility in Webster Parish is engaged in a $13 million expansion that will add 33 new jobs. The company manufactures under-carriages and bumpers for cars and trucks. A $35 million Spine Center of Excellence is under construction in Bossier City and should be completed in the second half of 2022.